区块链对数字人民币发行的影响

Understanding Blockchain's Impact on the Renminbi

Blockchain technology has emerged as a transformative force in the financial sector, offering numerous potential benefits and challenges for traditional currencies like the Renminbi (RMB). Here's a comprehensive analysis of how blockchain is influencing the future of the RMB:

Enhanced Transparency and Security:

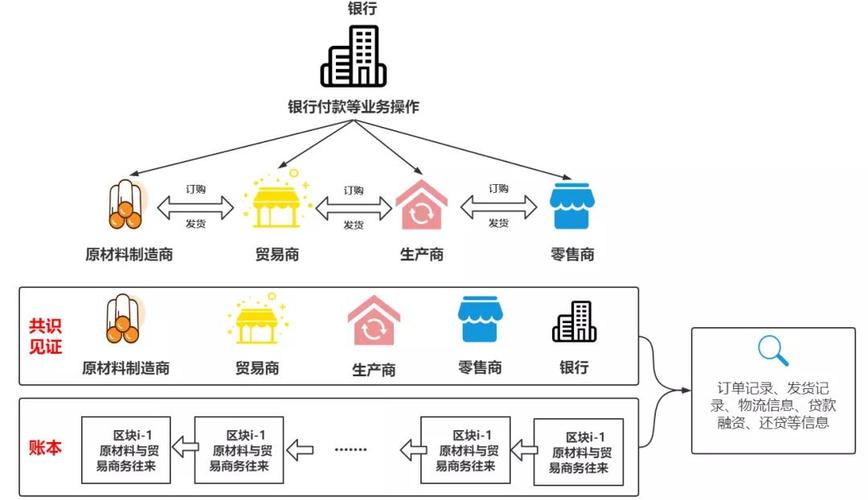

One of the key advantages of blockchain technology is its ability to provide transparent and secure transactions. By leveraging blockchain for RMB transactions, the Chinese government can enhance transparency in financial operations, reducing the risk of corruption and fraud. The immutable nature of blockchain ensures that once a transaction is recorded, it cannot be altered or tampered with, thereby bolstering the security of RMB transactions.Efficiency and Cost Reduction:

Blockchainpowered systems have the potential to streamline various financial processes, leading to increased efficiency and cost reduction. By using blockchain for RMB transactions, financial institutions can eliminate intermediaries and automate processes such as crossborder payments, thereby reducing transaction costs and processing times.Financial Inclusion:

Blockchain technology has the potential to enhance financial inclusion by providing access to financial services for underserved populations. By digitizing the RMB on a blockchain platform, individuals who lack access to traditional banking services can participate in the digital economy, empowering them to manage their finances more effectively.Challenges to Centralized Control:

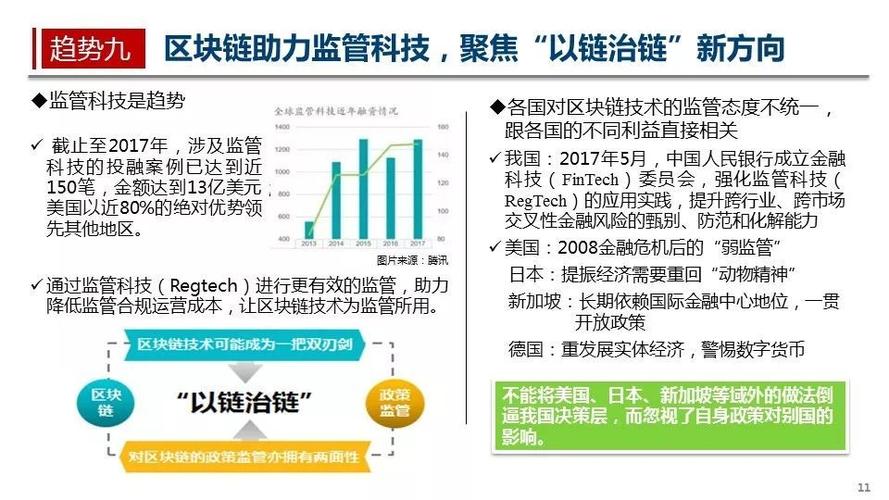

While blockchain offers numerous benefits, it also poses challenges to centralized control, which is a core tenet of China's financial system. The decentralized nature of blockchain networks may challenge the Chinese government's ability to maintain strict control over the RMB and its monetary policy. Additionally, the anonymity offered by some blockchain platforms could facilitate illicit activities such as money laundering and tax evasion, raising concerns for regulatory authorities.Integration with CBDC:

Central Bank Digital Currency (CBDC) initiatives are gaining traction globally, including in China. The People's Bank of China (PBOC) has been actively exploring the development of a digital version of the RMB, known as the Digital Currency Electronic Payment (DCEP). Blockchain technology could play a crucial role in the implementation of DCEP, enabling secure and efficient digital transactions while maintaining regulatory oversight.Internationalization of the RMB:

Blockchain technology has the potential to facilitate the internationalization of the RMB by simplifying crossborder transactions and reducing reliance on traditional correspondent banking networks. By embracing blockchain for international settlements, China can enhance the RMB's role in global trade and finance, challenging the dominance of traditional reserve currencies such as the US dollar.Conclusion:

In conclusion, blockchain technology holds immense promise for transforming the Renminbi and China's financial ecosystem. By leveraging blockchain for RMB transactions, the Chinese government can enhance transparency, efficiency, and financial inclusion while addressing challenges related to centralized control and regulatory compliance. Embracing blockchain technology can position the RMB for greater international prominence and pave the way for a more inclusive and efficient financial system. However, it is essential to navigate regulatory challenges and ensure responsible adoption to realize the full potential of blockchain for the Renminbi.

This evaluation serves as a foundational analysis of how blockchain technology is influencing the Renminbi. As the technology evolves and adoption expands, its impact on the RMB will continue to evolve, presenting both opportunities and challenges for policymakers, financial institutions, and stakeholders across the globe.