区块链融资平台有哪些

Title: Challenges in Blockchain Financing

Introduction:

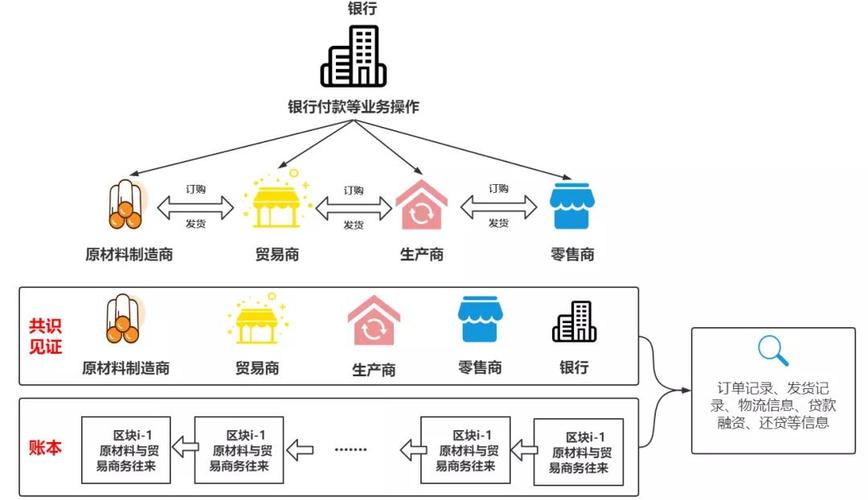

Blockchain technology has revolutionized various industries, including finance, by introducing decentralized and transparent systems for transactions and data management. However, like any emerging technology, blockchain financing faces its own set of challenges. Let's delve into some of these issues and explore potential solutions.

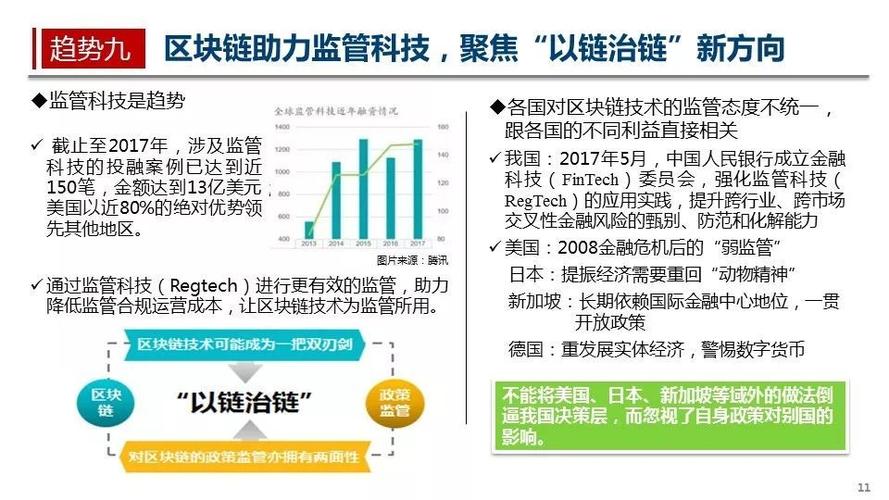

1. Regulatory Uncertainty:

One of the major challenges facing blockchain financing is the lack of clear and consistent regulations across different jurisdictions. Regulatory bodies worldwide are still grappling with how to classify and oversee cryptocurrencies and token sales, leading to uncertainty for investors and businesses alike.

*Recommendation:*

Governments and regulatory bodies need to collaborate with industry experts to develop comprehensive frameworks that address the unique characteristics of blockchainbased financing while ensuring investor protection and market integrity.

2. Security Concerns:

Despite the inherent security features of blockchain technology, the ecosystem is not immune to cyber threats. Hacking incidents, smart contract vulnerabilities, and fraudulent activities have raised concerns among investors and hindered mainstream adoption.

*Recommendation:*

Continuous investment in robust security measures, including regular audits, penetration testing, and the adoption of best security practices, is essential to mitigate risks and enhance trust in blockchain financing platforms.

3. Scalability Issues:

Scalability remains a significant bottleneck for blockchain networks, especially in the context of financing applications. As transaction volumes increase, blockchain platforms often struggle to process them efficiently, leading to congestion and high fees.

*Recommendation:*

Research and development efforts should focus on scaling solutions such as layer 2 protocols, sharding, and consensus algorithm improvements to enhance the throughput and performance of blockchain networks, making them more suitable for financing applications at scale.

4. Lack of Interoperability:

Interoperability between different blockchain networks and legacy systems is crucial for the seamless transfer of assets and data in blockchain financing. However, achieving interoperability remains a challenge due to the fragmentation of the blockchain ecosystem.

*Recommendation:*

Standardization initiatives and interoperability protocols should be promoted to facilitate communication and data exchange between diverse blockchain networks, enabling greater integration with existing financial infrastructure and improving accessibility for users.

5. Market Volatility:

The highly volatile nature of cryptocurrencies poses a challenge for blockchain financing, affecting investor confidence and project sustainability. Sharp price fluctuations can lead to liquidity issues and project failures, particularly for startups relying on token sales for funding.

*Recommendation:*

Diversification strategies, risk management tools, and stablecoin integration can help mitigate the impact of market volatility on blockchain financing activities. Additionally, educating investors about the risks associated with cryptocurrency investments is essential for fostering a more stable and resilient ecosystem.

Conclusion:

Despite its transformative potential, blockchain financing faces several challenges that need to be addressed to realize its full benefits. Regulatory clarity, enhanced security measures, scalability improvements, interoperability standards, and risk management strategies are key areas that require concerted efforts from industry stakeholders. By tackling these challenges collaboratively, we can pave the way for a more robust and inclusive blockchain financing ecosystem.

References:

"Regulatory Challenges in Blockchain and Cryptocurrency Adoption" World Economic Forum

"Blockchain Security: Issues, Challenges, and Solutions" IEEE Xplore

"Scalability Solutions for Ethereum" Ethereum Foundation

"Interoperability in Blockchain: Present and Future" BIS Research

"Managing Cryptocurrency Volatility" Deloitte Insights